Basic corporate governance policy

The istyle Group believes that our success fundamentally depends on earning a reputation for the neutrality and reliability of the community websites that make up the core of our business. As such, it is our philosophy that building trust in the Group as a whole is of the highest importance in order to maintain our good reputation among consumers. Of course, the Internet industry is subject to significant changes due to external influences, and the Group maintains a strong awareness that we face particular management challenges as a member of that industry. It is with these challenges in mind that we make every effort to strengthen our corporate governance by improving our flexibility, transparency, objectivity, and the overall soundness of our management.

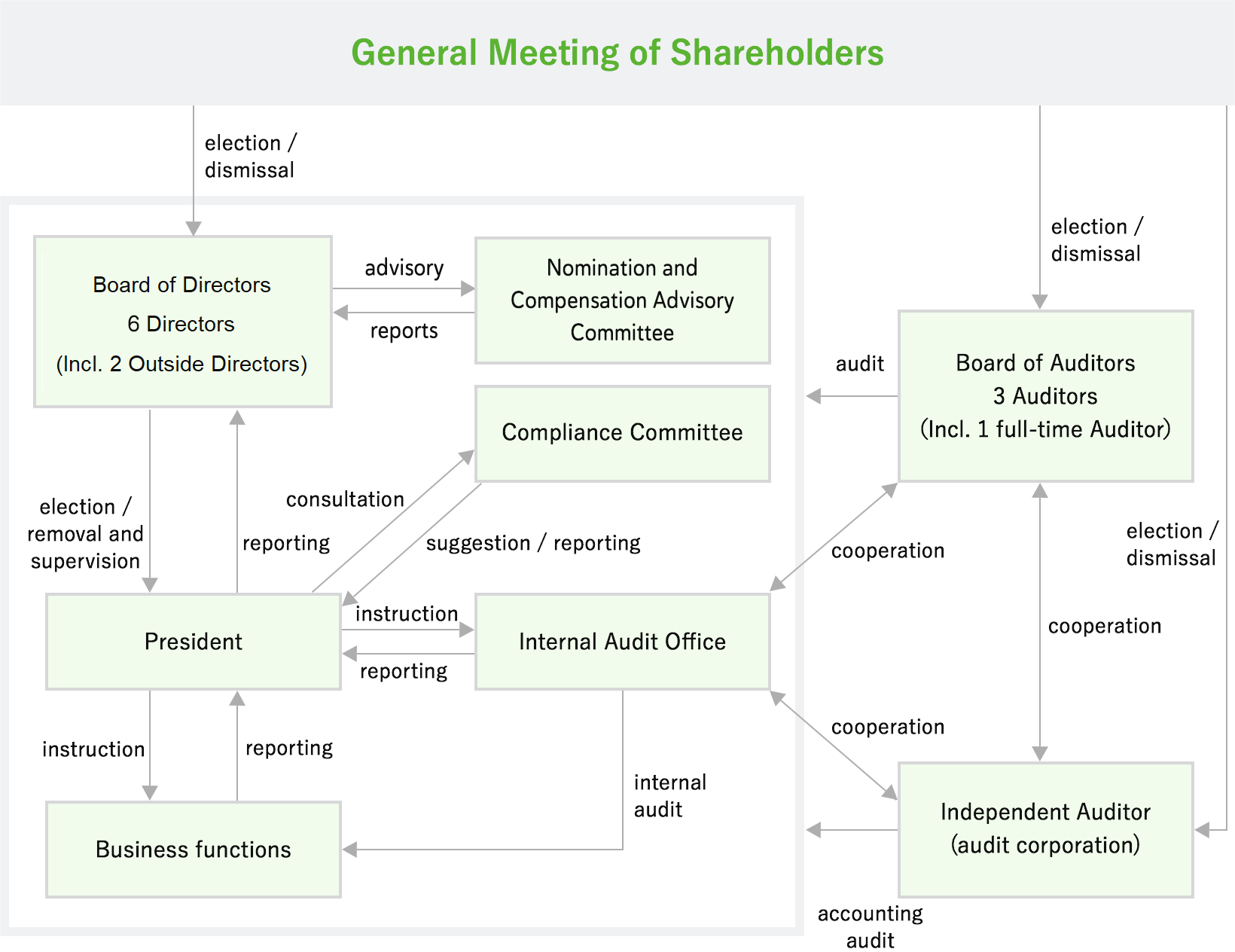

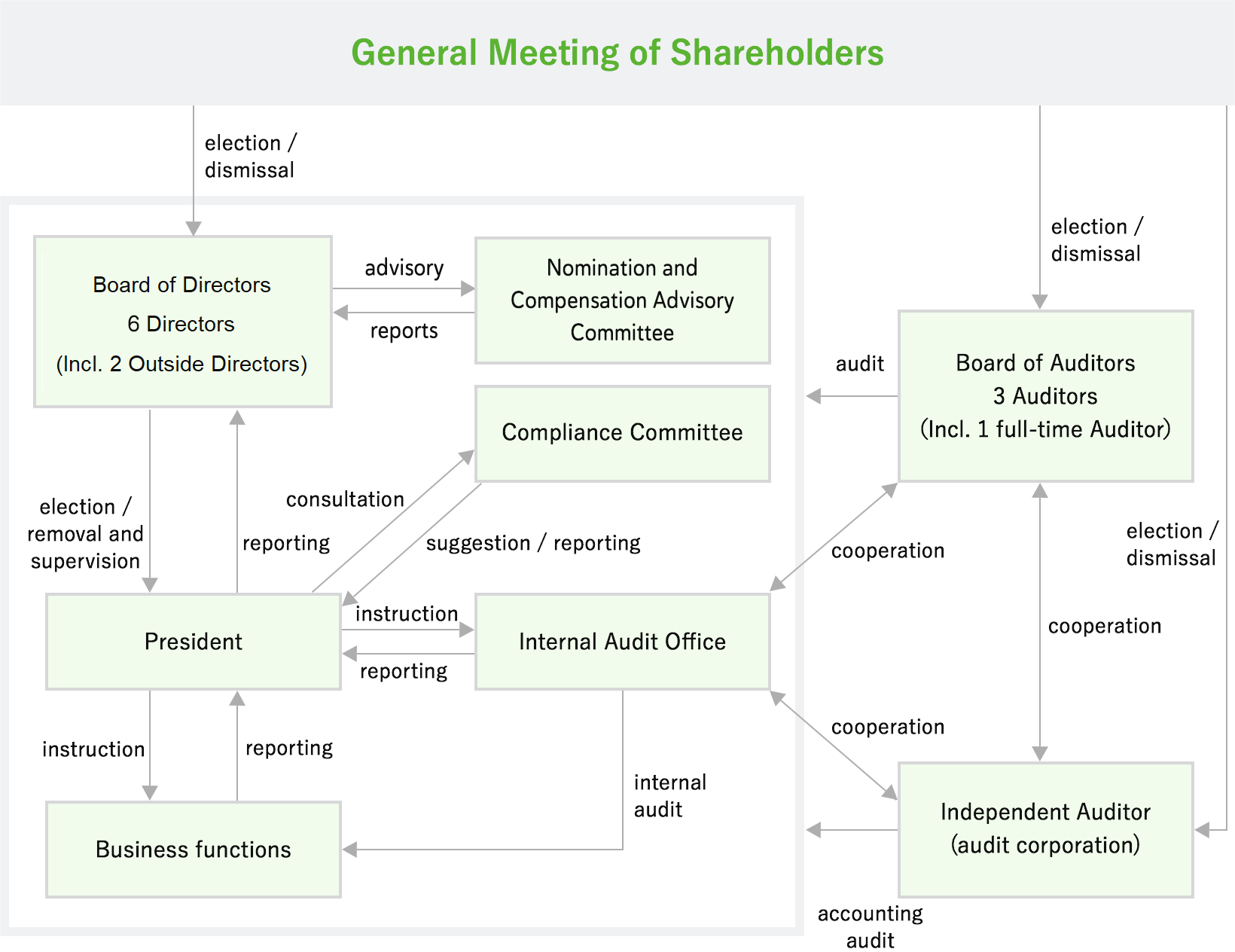

Corporate governance organizational chart and summary

| Name | Position | Board of Directors |

Board of Auditors |

Strategy meeting |

Management meeting |

Nomination and Compensation Advisory Committee |

Compliance Committee |

|---|---|---|---|---|---|---|---|

| Tetsuro Yoshimatsu | Representative Director Chairperson and CEO |

◎ | ◎ | ○ | ○ | ||

| Hajime Endo | Representative director President and COO |

○ | ○ | ◎ | ○ | ||

| Kei Sugawara | Director Vice Chairperson and CFO |

○ | ○ | ○ | ◎ | ||

| Meyumi Yamada | Director | ○ | ○ | ○ | |||

| Michimasa Naka | Director (Outside) | ○ | ◎ | ||||

| Shinsuke Usami | Director (Outside) | ○ | |||||

| Hikari Kanokogi | Director (Outside) | ○ | ○ | ||||

| Mie Miura | Director (Outside) | ○ | |||||

| Hitoshi Hara | Auditor (Outside) | ○ | ◎ | ○ | ○ | ||

| Kenji Miyako | Auditor (Outside) | ○ | ○ | ||||

| Junko Kotakemori | Auditor (Outside) | ○ | ○ | ||||

| Senior Executive Officers | ○ | ○ | |||||

| Head of business execution function |

○ | ○ | |||||

| General Managers of related departments |

○ | ○ |

◎ : Chair of the deliberation body○ : Members of the body

- Board of Directors

- The Board of Directors comprises eight Directors (of which four are Outside Directors), and in addition to regular meetings held every month, extraordinary meetings of the Board of Directors are also held as necessary in a flexible manner. In addition to making decisions on basic policies on management, the Board supervises the execution of Directors' duties. In addition, three Auditors (all of which are Outside Auditors) attend every meeting of the Board of Directors and audit the legality of decision-making and business execution among others.

- Auditors and the Board of Auditors

- The Company has selected three Auditors (all of which are Outside Auditors), comprising one full-time and two part-time. All three Auditors attend the meetings of the Board of Directors, and the full-time Auditor attends other important meetings including the management meeting to examine the execution status of Directors' duties as well as the development and operation status of the internal control system, expressing opinions as necessary.

Additionally, the Board of Auditors, in principle, meets once a month, to determine the audit policy and to report on and deliberate the audit results of each Auditor. - Strategy meeting

- The strategy meetings are composed of directors, including the CEO (excluding outside directors), and senior executives. These meetings are held twice a month to deliberate on matters related to management, such as business plans and strategic initiatives, with a focus on the most critical issues.

- Management meeting

- The management meeting comprises the Directors including Representative Directors (excluding Outside Directors), the full-time Auditor and the heads of each business function, etc., and meets once a week to deliberate important management matters including the business plan and management strategies, and to report on and supervise the execution status of their respective businesses.

- Nomination and Compensation Advisory Committee

- The majority of the members of the Nomination and Compensation Advisory Committee comprises independent Outside Directors and independent Outside Auditors, and the committee makes appropriate reports in response to inquiries from the Board of Directors regarding basic compensation for each Director.

- Compliance Committee

- The Compliance Committee is chaired by the Officer in charge of compliance with members comprising Representative Directors, the full-time Auditor, related officers and general managers, and engages in compliance promotion activities, counters compliance violations, and carries out operations pursuant to whistle-blowing regulations, among others, in an effort to ensure the promotion of compliance-oriented management.

Diversity of Directors and Auditors

In the event that the Proposals are approved, the composition of the Board of Directors and the Board of Auditors, as well as the expertise of each officer is as follows.

The skill items in the below table are organized based on the skills and experience required to achieve the Mid-term Business Targets formulated in the fiscal year ended June 30, 2024, and do not express all of the knowledge and experience held by each Director candidate and Auditor.

Status of Outside Officers

The Company has four Outside Directors and three Outside Auditors.

The Company has established the following criteria for Outside Directors and Outside Auditors that are independent from the Company. In appointing Outside Directors and Outside Auditors, the Company selects candidates who satisfy the "Criteria for Independence of Outside Directors and Outside Auditors" established independently by the Company, in addition to the criteria stipulated by the Companies Act and the Tokyo Stock Exchange.

Criteria for Independence of Outside Directors and Outside Auditors

In principle, the Company designates Independent Outside Officers from persons who do not meet any of the following items.

(1) A person who holds the Company to be a major business partner (refers to a party that received payments from the Group in an amount of 2% or more of the party's consolidated net sales in the most recent fiscal year), or a business executor thereof.

(2) A person who is a major business partner of the Company (refers to a party that made payments to the Group that accounted for 2% or more of the Company's consolidated net sales in the most recent fiscal year, or balance of loans to the Group that accounted for 2% or more of the Company's consolidated total assets), or a business executor thereof.

(3) A consultant, accounting expert or legal expert who receives large amounts of money or other assets, excluding Director compensation, from the Group (in the case that the party receiving said assets is an organization such as a corporation or association, then persons who belong to the organization in question).

- (Note)

- A business executor is defined in the Regulations for Enforcement of the Companies Act, and includes not only executive Directors, but employees as well.

- A large amount refers to an amount of ¥10 million or more in the most recent fiscal year for an individual, and an amount of 2% or more of total income in the most recent fiscal year for an organization (corporation, association, etc.).

The Company has registered Outside Directors Michimasa Naka, Hikari Kanokogi and Mie Miura, Outside Audit & Supervisory Board Members Hitoshi Hara, Kenji Miyako, and Junko Kotakemori as Independent Directors/Audit & Supervisory Board Members with Tokyo Stock Exchange, Inc.

Outside Director Michimasa Naka serves concurrently as Director of Vision Inc. and Vector Inc., and the Group engages in business transactions with these companies. However, the Company recognizes that independence is sufficiently ensured since transactions with these companies account for less than 2% of these companies' or the Group's consolidated net sales in the most recent fiscal year. Outside Director Mie Miura served as CFO and Executive Officer of Shiseido Japan Co., Ltd., which is a major business partner of the Group, until March 2025, but we have determined that she does not have any influence that would cause a conflict of interest with general shareholders, and her independence is sufficiently ensured. Outside Audit & Supervisory Board Member Kenji Miyako serves concurrently as Audit & Supervisory Board Member of GLOBIS Corporation and Open8 Inc., and as Outside Director Audit Committee Member of CyberBuzz, Inc. The Group engages in business transactions with these companies. However, the Company recognizes that independence is sufficiently ensured owing to the fact that transactions with these companies account for less than 2% of these companies' or the Group's consolidated net sales in the most recent fiscal year. The number of shares held by each Outside Officer is as stated in 1) List of members of the Board of Directors and Audit & Supervisory Board. No other special interests exist between the Company and Outside Directors or Outside Audit & Supervisory Board Members other than those mentioned above, including personal relationships, capital relationships, and business relationships.

| Name (Date of birth) |

Career profile |

|---|---|

|

|

|

|

|

|

|

|

| Name (Date of birth) |

Career profile |

|---|---|

|

|

| Name (Date of birth) |

Career profile |

|---|---|

|

|

|

|

- (Notes)

- Messrs. Michimasa Naka and Shinsuke Usami and Mses. Hikari Kanokogi and Mie Miura are candidates to become Outside Directors.

- Audit & Supervisory Board Members Hitoshi Hara, Kenji Miyako, and Junko Kotakemori are Outside Audit & Supervisory Board Members.

- The number of shares held by each Director and Audit & Supervisory Board Member represents the effective number of shares held, including equity in the Directors' Shareholding Association of the Company. The number of shares held by each Director and Audit & Supervisory Board Member represents the effective number of shares held as of June 30, 2025.

- The terms of Directors are from the conclusion of the Annual General Meeting of Shareholders for the fiscal year ended June 30, 2025, to the conclusion of the Annual General Meeting of Shareholders for the fiscal year ending June 30, 2026.

- The terms of the Audit & Supervisory Board Members are from the conclusion of the Annual General Meeting of Shareholders for the fiscal year ended June 30, 2023, to the conclusion of the Annual General Meeting of Shareholders for the fiscal year ending June 30, 2027.

Cooperation with Outside Directors and Outside Auditors

The Outside Directors and the Outside Audit & Supervisory Board Members have experience in corporate management and possess broad knowledge and experience as certified public accountants and certified public tax accountants. These Directors and Audit & Supervisory Board Members attend meetings of the Board of Directors of the Company to provide supervision, advice, and audits on decision-making related to the execution of business activities. The Outside Directors strive to improve the efficiency and effectiveness of operations by exchanging information with administration and internal control departments. The Outside Audit & Supervisory Board Members strive to improve the efficiency and effectiveness of audits through cooperation with the Internal Audit Office and internal control departments by exchanging information.

Compensation paid to officers

Matters relating to the amount of officer compensation, etc. and policy for the determination of its calculation method

a ) Compensation, etc., for Directors

The Board of Directors, at its meeting held on August 12, 2025, passed the following resolution regarding the policy for determining the details of compensation, etc. for each individual Director for the current fiscal year.

1) Fixed compensation

Fixed compensation for directors shall be paid monthly, with the total amount to be determined based on the base amount according to the position and duties, and taking into consideration the performance for each fiscal year. The amount for each director shall be determined by taking into consideration the Company's operating results, management details, economic situation, each director's annual performance evaluation, etc., and the responsibilities to be assumed in the following fiscal year.

2) Performance-linked remuneration

The performance-linked remuneration shall be paid in cash and shall be calculated by multiplying each fixed compensation by a percentage after deducting 100% from the percentage of achievement of the consolidated forecast as of the beginning of the fiscal year as stated in the Summary of Consolidated Financial Results (however, if the percentage is less than 120%, the performance-linked remuneration shall not be paid) for the following components of performance indicators in each fiscal year, according to each position. The performance-linked remuneration shall be paid to executive directors at a certain time each year in the following amounts: up to 30 million yen for Representative Director, Chairperson and CEO; up to 20 million yen for Representative Director, President and COO; and up to 20 million yen for Director, Vice Chairperson and CFO. The performance indicators selected as the basis for calculating the amount of performance-linked remuneration, etc. include profit attributable to owners of the parent of the Company and consolidated operating profit for each fiscal year. In the current fiscal year, profit attributable to owners of the parent amounted to 2,327 million yen, and consolidated operating profit was 3,164 million yen. Additionally, the reason for selecting these performance indicators is that we have determined that each is an appropriate indicator, as profit attributable to owners of the parent company is from the perspective of sharing interests with shareholders, and consolidated operating profit is for securing and improving the profitability of the Group. Officers receive no non-monetary compensation, etc.

| Position | Profit attributable to owners of the parent company | Consolidated operating profit |

| Representative Director, Chairperson and CEO | 100% | - |

| Representative Director, President and COO | 30% | 70% |

| Director, Vice Chairperson and CFO | 70% | 30% |

3) Details of non-monetary compensation, etc.

As non-monetary compensation, specified restricted stock (the Transfer Restriction Period shall be a period determined by the Board of Directors of the Company between 3 years and 50 years, and the Transfer Restriction shall be terminated subject to the retirement or resignation of a director of the Company or any other position determined by the Board of Directors of the Company) shall be granted. The granted number shall be determined in accordance with the position and the stock shall be paid to the executive directors at a certain time each year.

The ratio of the specified restricted stock to monetary compensation, etc. shall be set at an appropriate ratio in consideration of the Group's performance, the level of other companies, economic environment, etc., in order to ensure a level that can be expected to have an incentive effect on each executive director to improve performance, based on the purposes of the Corporate Governance Code.

4) Method of determining compensation, etc.

Basic compensation for Directors will be determined by the Board of Directors after consultation with and report to the Nomination and Compensation Advisory Committee, the majority of whose members are independent Outside Directors and independent Outside Auditors.

b ) Compensation, etc., for Auditors

Compensation for Auditors is determined through discussions within the Board of Auditors.

At the 5th Annual General Meeting of Shareholders held on September 28, 2004, the maximum amount of total compensation for Auditors was resolved to be within 50 million yen per year. No more than four Auditors are allowed to serve under the Articles of Incorporation.

Total amount of compensation and compensation by type, by number of recipients, and by class of officers

| Category | Total compensation (Millions of yen) |

Total compensation by compensation type (Millions of yen) |

Number of officers (Persons) |

|||

|---|---|---|---|---|---|---|

| Fixed compensation |

Performance- linked compensation |

Retirement benefits |

Non-monetary compensation, etc. of the left items |

|||

| Directors (excluding Outside Directors) |

209 | 146 | 63 | - | - | 4 |

| Audit & Supervisory Board Members (excluding Outside Auditors) |

- | - | - | - | - | - |

| Outside Director/ Auditor |

34 | 34 | - | - | - | 6 |

- (Notes)

- The maximum amount of compensation approved at the General Meeting of Shareholders is a maximum 250 million yen per year for Directors and a maximum 50 million yen per year for Audit & Supervisory Board Members, including respective bonuses for Directors and Audit & Supervisory Board Members. The total amount of compensation for Directors is set at a maximum of 400 million yen per year, as approved by the resolution of the General Meeting of Shareholders held on September 27, 2025.

Total amount of compensation, etc., for each officer of the filing company, etc.

As there are no officers for whom the total amount of compensation, etc., is 100 million yen or more, this information is omitted.

Significant items among employee salaries paid to officers concurrently serving as employees

As there are no officers concurrently serving as employees, there is no relevant information.

Policy on anti-social forces

We explicitly delineate our code of conduct in our Compliance Regulations, stating, "We take resolute action against anti-social forces that would threaten the social order and sound operation of going concerns, taking no part in illegal or anti-social activity, and provide no benefit to anti-social forces, including but not limited to financial support, irrespective of whether in substance or form."

Per this code of conduct, seeking to prevent the incursion of anti-social forces in company management and from causing damages, we obtain information through third-party survey organizations at the start of trade with other parties and once annually thereafter in order to establish that the other party bears and continues to bear no relations with anti-social forces.

We also undertake courses provided by the Tokyo Citizens' Center for Expulsion of Anti-Social Forces on non-engagement with anti-social forces and what to do in the event of an unlawful demand from anti-social forces, using this to better improve our organizational approach to these issues.

We delineate an explicit manual and protocol for response to anti-social forces and what to do to research our transactional partners and handle unlawful requests.

We thoroughly disseminate the above code of conduct and manual to officers and employee and, through the administration departments under their purview, partner with attorneys, law enforcement, and other external organs for the ongoing training and edification of employee and the continued enhancement of an internal system for the expulsion of anti-social forces from society.